Prevailing Wages Law In Washington For Roofing

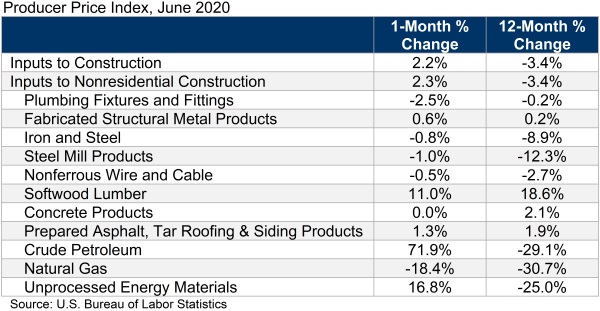

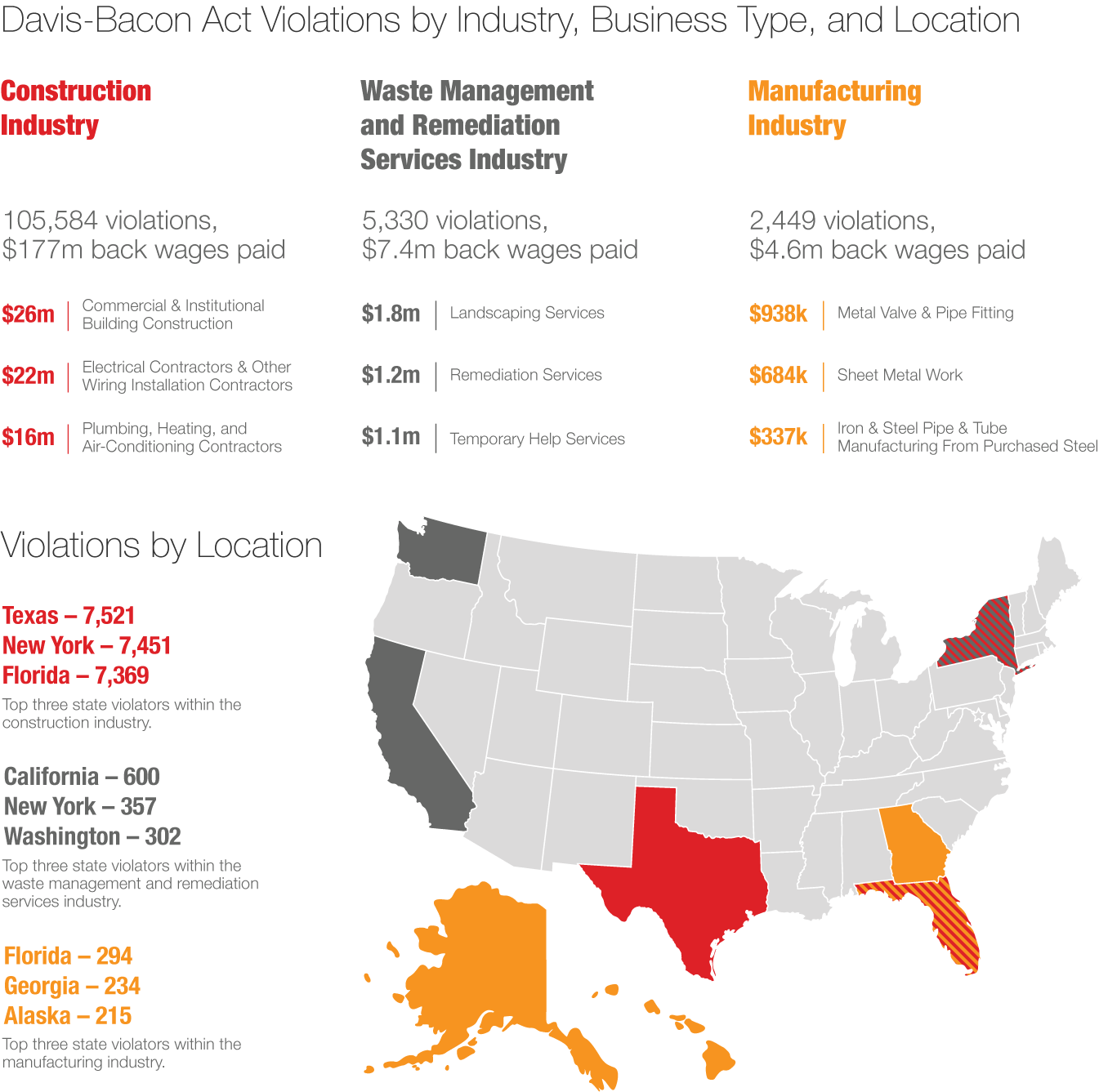

These laws require payment of the prevailing wages determined in accordance with the davis bacon act on federally assisted construction undertaken pursuant to the relevant law.

Prevailing wages law in washington for roofing. The prevailing wage rates are usually based on rates specified in collective bargaining agreements. Examples of the related acts are the federal aid highway acts the housing and community development act of 1974 and various other hud administered laws and the. Certain owners of the business do not have to pay themselves prevailing wages. View the publication of all updates and corrections to any prevailing wage rate.

If the same worker then does the work in another trade. An apprentice carpenter doing carpenter work will be paid at an apprentice wage rate. For example davis bacon prevailing wage provisions would apply to a construction contract located in guam or the virgin islands funded under the housing and community development act of 1974 even though the davis bacon act itself does not apply to federal construction contracts to be performed outside the 50 states and the district of columbia. This fact sheet provides general information concerning the application of the federal child labor provisions as they relate to the employment of youth in roofing operations and on or about a roof.

Scopes of work trades. Requirement to pay prevailing wages the intent and affidavit forms still must be submitted. Such owners must own at least 30 of the business. Supervisors who do no trade work are exempt.

They can also assess interest at 1 percent per month for each occurrence or employee. All workers employed on public works projects must be paid the prevailing wage determined by the director of the department of industrial relations according to the type of work and location of the project. Look up a description of the trade and occupation classifications. The statute of limitations for overtime claims is two years ors 12 110 3.

However those supervisors who participate. The civil penalty for the non payment of prevailing wage is a minimum of 5 000 or an amount equal to 50 percent of the total wage violation found on the contract whichever is greater. All other employees are paid full journey level prevailing wages. Prevailing wage rate violations by employers are subject to wage claims initiated by employees for up to six years from the date of the violation ors 12 080 1.

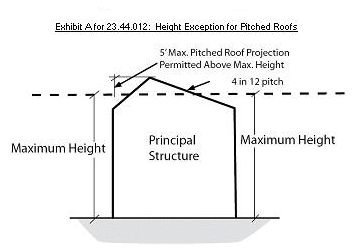

The hourly wages to be paid to laborers workers or mechanics upon all public works and under all public building service maintenance contracts of the state or any county municipality or political subdivision created by its laws shall be not less than the prevailing rate of wage for an hour s work in the same trade or occupation in the locality within the state where such labor is performed.