Prevailing Wages Law In Washington Roofing

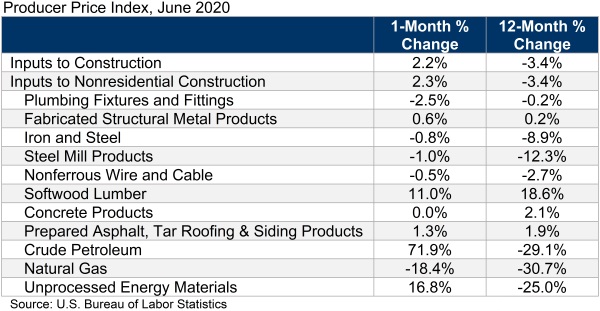

The prevailing wage rates are usually based on rates specified in collective bargaining agreements.

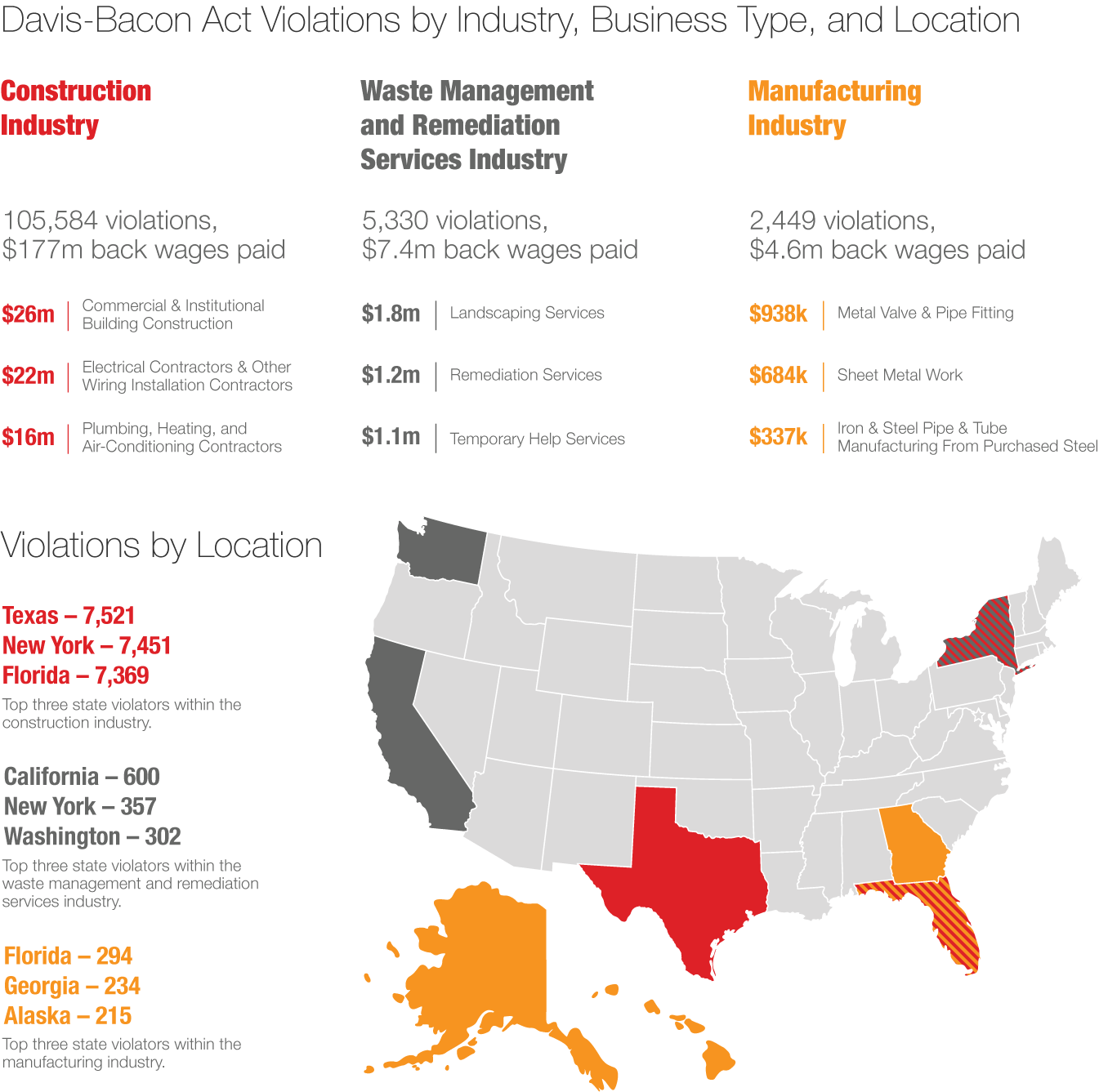

Prevailing wages law in washington roofing. The law enacted in 1945 the washington state public works act act also known as the prevailing wage law is a worker protection act. The statute of limitations for overtime claims is two years ors 12 110 3. Chapter 39 12 rcw requires local government contractors and subcontractors to pay prevailing wages to all workers for all public works and maintenance contracts regardless of the dollar value of the contract. Davis bacon act and related act contractors and subcontractors must pay their laborers and mechanics employed under the contract no less than the locally prevailing wages and fringe benefits for corresponding work on similar projects in the area.

The federal child labor provisions of the flsa are administered by the wage and hour division whd which is part of the u s. The work of roofers includes but is not limited to. Prevailing wage requirements in washington. These laws require payment of the prevailing wages determined in accordance with the davis bacon act on federally assisted construction undertaken pursuant to the relevant law.

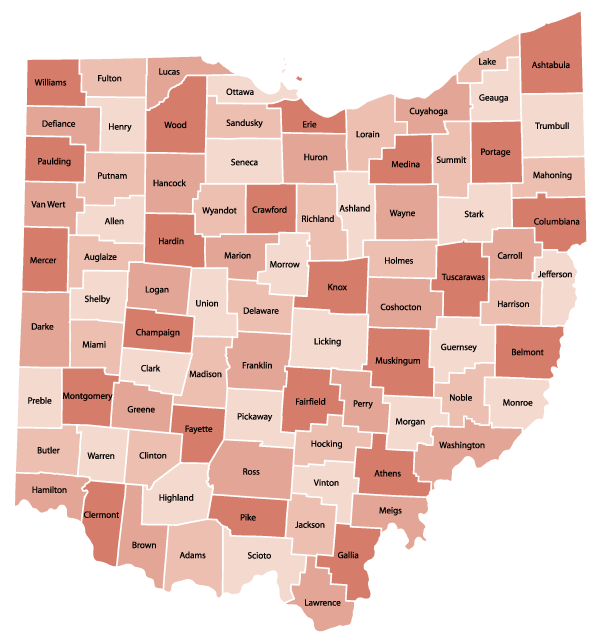

The davis bacon act directs the department of labor to determine such locally prevailing wage rates. Location 7273 linderson way sw. This fact sheet provides general information concerning the application of the federal child labor provisions as they relate to the employment of youth in roofing operations and on or about a roof. All workers employed on public works projects must be paid the prevailing wage determined by the director of the department of industrial relations according to the type of work and location of the project.

Chapter 39 12 rcw requires local government contractors and subcontractors to pay prevailing wages to workers on all public works and maintenance contracts on public buildings and projects regardless of the dollar value of the contract. Prevailing wage rate violations by employers are subject to wage claims initiated by employees for up to six years from the date of the violation ors 12 080 1. Washington prevailing wage rules.